What's a portable card reader and what can you do with it?

SumUp Air

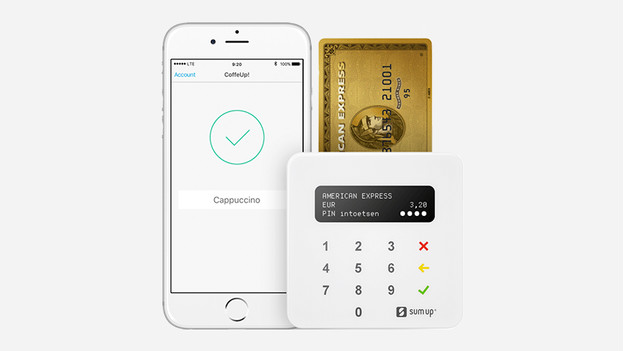

With the SumUp Air contactless PIN device, you'll receive payments wherever you want without any problem. Connect the PIN device to your smartphone or iPad via Bluetooth in order to receive bank card or credit card payments.

What's a portable PIN device?

A portable PIN device is a payment system you can use to accept and process PIN payments. This is convenient when you have your own business at home or when you work on variable locations. It allows customers to pay not only in cash, but also with a debit card or credit card. A mobile PIN device brand like SumUp will accept any debit card or credit card. Think of Visa, VPAY, Maestro, and American Express. Paying using Android Pay or Apple Pay is possible too. Contactless payment is possible using the magnet strip, or by sliding the card into the device. The amount paid will then be added to your bank account within 2 to 3 business days.

When is a portable PIN device useful?

A portable PIN device comes in handy for small and medium-sized businesses with a Chamber of Commerce number. It's also useful when you're on the go a lot or when you visit customers at their homes. On top of that, it ensures you won't have to carry large amounts of cash, which is a lot safer, of course. Another advantage of a portable PIN device is its compact size. This allows you to carry it in your pocket without a problem. You won't need to worry about an empty battery with SumUp either, since it will last for at least 500 transactions. You can easily charge the SumUp using the included micro USB cable.

What will I need for it?

In order to use a portable PIN device, you should first download the accompanying app. Next, create an account and connect the PIN device to your smartphone or tablet via Bluetooth. SumUp works with both iOS and Android, which means it can be used on pretty much any device. Does a customer want to pay? Enter the amount using the app. After this, the payment may be made using the SumUp PIN device. The payment will be registered, and the app will also give you the option of sending a proof of payment to your customer's email address.

How much does a portable PIN device cost?

When you buy a portable card reader by SumUp, you'll pay procurement costs for the product. You don't have to pay any installation costs and there isn't a fixed, monthly rate for service costs for example. Instead of this, you'll pay SumUp a percentage per transaction. In the Netherlands, this is 1.9% per transaction, and in Belgium it's 1.69%. Aren't you using the SumUp for a while, because your on a vacation for example? You won't have to pay for anything.

Conclusion

Do you, as an entrepreneur, want to give your customers the option of paying with a debit card? Or are you fed up with having to walk around carrying cash all the time? In that case, a portable card reader may be a good solution for you. Portable card readers are user-friendly, safe, and affordable. They will definitely be an investment in your company.